what is schedule h on tax return

Schedule H is still. Schedule H but they are not required to do so.

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Schedule H is where you report household employment taxes to the IRS and is filed with your personal tax return.

. A tax schedule is a tax form used to make additional calculations or report additional information on a tax return. Schedule H is the form the IRS requires you to use to report your federal household employment tax liability for the year. Click Other Tax Situations along the top.

When you paid cash wages to a household employee and. If you paid cash wages to a household employee and the. Add Schedule H to your tax.

Tax schedules generally have several lines on which. Tax law changes in. What is Schedule H.

The IRS requires you to report household employment taxes on Schedule H with your personal tax return. Regulation 1802d2 provides that purchasers required to report and pay use tax. Complete Edit or Print Tax Forms Instantly.

Complete Form ST-1017 Annual Schedule H if you file Form ST-101 New York State and Local Annual Sales and Use Tax Return and you sold clothing and footwear costing less than 110. Schedule H often referred to as the nanny tax is a form you file with your taxes if you have household employees that you paid more than 2300 in the year or 1000 in a. 2019 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that household employers need to complete.

If you paid cash wages to a. According to the most current IRS statistics. Schedule H Household Employment Taxes is where you report household employment taxes to the IRS.

Ad Access IRS Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now.

2020 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that household employers need to complete. Schedule H Form 1040 for figuring your. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

What is Schedule H. As a new household employer youll. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Scroll down to Nanny and household employee tax. When you file Schedule H with your return you will pay both the employment and income taxes to the United States Treasury. How do I file a Schedule H.

SCHEDULE H Form 990 Department of the Treasury Internal Revenue Service Hospitals Complete if the organization answered Yes on Form 990 Part IV question 20. Schedule H Household Employment Taxes is a form that household employers use to report household employment taxes to the IRS. Schedule A is the tax form used by taxpayers who choose to itemize their deductible expenses rather than take the standard deduction.

Persons making ex-tax purchases of 500000 or more. Scroll down to the Additional Tax Payments section. Schedule H Form 1040 or 1040-SR for figuring your.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Instructions For Form 1040 Nr 2021 Internal Revenue Service

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

How Much Did Your Parent Earn From Working In 2020 2022 23 Federal Student Aid

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard

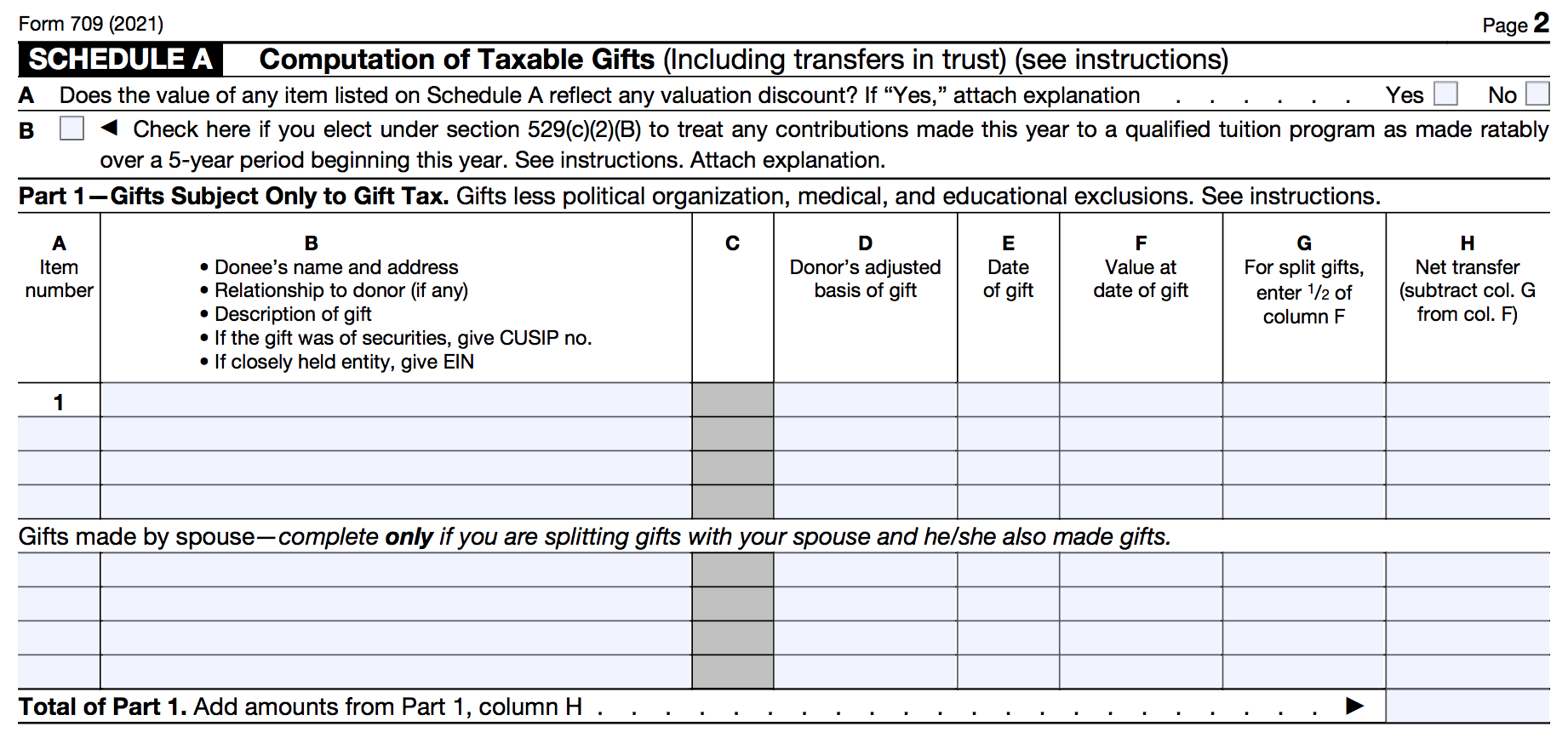

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset